The 30-Second Trick For Estate Planning Attorney

The 30-Second Trick For Estate Planning Attorney

Blog Article

The Facts About Estate Planning Attorney Uncovered

Table of ContentsThe Of Estate Planning AttorneyEstate Planning Attorney - TruthsThe smart Trick of Estate Planning Attorney That Nobody is Talking About9 Easy Facts About Estate Planning Attorney ShownMore About Estate Planning Attorney

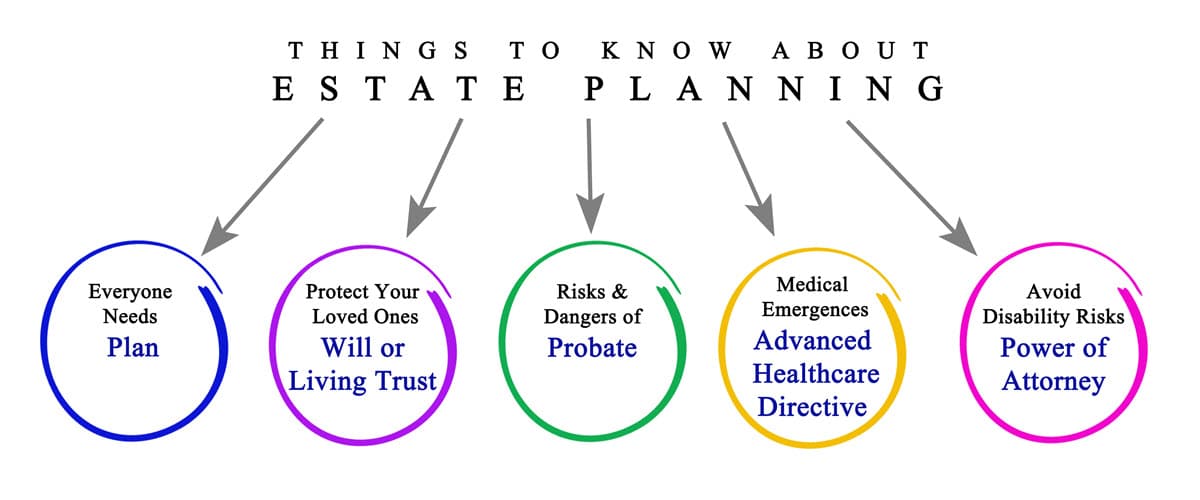

Facing end-of-life choices and securing family members wealth is a challenging experience for all. In these challenging times, estate preparation attorneys assist people prepare for the circulation of their estate and develop a will, trust fund, and power of lawyer. Estate Planning Attorney. These attorneys, additionally referred to as estate legislation attorneys or probate attorneys are licensed, knowledgeable professionals with a thorough understanding of the federal and state laws that relate to just how estates are inventoried, valued, distributed, and exhausted after fatality

The intent of estate planning is to properly get ready for the future while you're audio and capable. An appropriately prepared estate strategy sets out your last desires exactly as you want them, in one of the most tax-advantageous way, to avoid any type of inquiries, misconceptions, misconceptions, or disputes after death. Estate preparation is a field of expertise in the legal career.

Examine This Report about Estate Planning Attorney

These attorneys have a thorough understanding of the state and federal laws associated to wills and trusts and the probate process. The tasks and duties of the estate lawyer may include counseling clients and drafting legal papers for living wills, living trust funds, estate plans, and estate taxes. If needed, an estate preparation attorney may join lawsuits in court of probate on part of their clients.

, the work of lawyers is anticipated to grow 9% between 2020 and 2030. Regarding 46,000 openings for attorneys are predicted each year, on standard, over the years. The path to becoming an estate planning attorney is comparable to various other technique areas.

When possible, take into consideration chances to acquire real-world work experience with mentorships or teaching fellowships connected to estate planning. Doing so will certainly give you the skills and experience to earn admission into law institution and network with others. The Law College Admissions Test, or LSAT, is an essential component of putting on regulation institution.

Commonly, the LSAT is readily available 4 times annually. It's crucial to prepare for the LSAT. The majority of potential trainees start studying for the LSAT a year ahead of time, frequently with a study hall or tutor. A lot of law students get law school during the fall term of the final year of their undergraduate researches.

The Best Strategy To Use For Estate Planning Attorney

Typically, the annual wage for an estate attorney in the U.S. is $97,498. Estate Planning Attorney. On the luxury, an estate preparation attorney's wage might be $153,000, according to ZipRecruiter. The quotes from Glassdoor are similar. Estate intending attorneys can operate at huge or mid-sized law practice or branch dig this out on their very own with a solo technique.

This code associates with the restrictions and guidelines enforced on wills, depends on, and various other lawful files pertinent to estate preparation. The Attire Probate Code can vary by state, yet these legislations govern various aspects of estate preparation and probates, such as the creation of the count on or the lawful validity of wills.

It is a tricky concern, and there is no simple answer. You can make some considerations to assist make the choice less complicated. As soon my response as you have a checklist, you can narrow down your options.

It entails making a decision just how your belongings will certainly be distributed and that will manage your experiences if you can no more do so yourself. Estate planning is a necessary part of financial preparation and must be done with the assistance of a certified professional. There are a number of elements to take into consideration when estate preparation, including your age, health, financial situation, and family members scenario.

Our Estate Planning Attorney Diaries

If you are young and have couple of properties, you may not require to do much estate planning. Health: It is a crucial element to consider when estate preparation.

If you are married, you have to consider exactly how your properties will certainly be dispersed in between your spouse and your heirs. It intends to make certain that your assets are dispersed the means you desire them to be after you die. It consists of thinking about any type of taxes that may require to be paid on your estate.

Some Known Factual Statements About Estate Planning Attorney

The lawyer also assists the people and families develop a will. A will certainly is a lawful record mentioning how individuals and useful content households want their assets to be dispersed after fatality. The attorney additionally assists the people and households with their depends on. A count on is a lawful record enabling people and family members to transfer their assets to their recipients without probate.

Report this page